‘Free’ Solar Panels Are Not Free: What You Need to Know

If a company is advertising “free” solar panels, it may not be a scam — but it is misleading.

Leonardo David is an electromechanical engineer, MBA, energy consultant and technical writer. His energy-efficiency and solar consulting experience covers sectors including banking, textile manufacturing, plastics processing, pharmaceutics, education, food processing, real estate and retail. He has also been writing articles about energy and engineering topics since 2015.

Renewable Energy Tax Credits Overview

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

You have probably seen ads from solar companies offering “free” solar panels. While these offers are not necessarily scams, they can be misleading. Although the company will not charge any money up-front for solar panels for your home. you must agree to pay a monthly fee for using their solar panels. In other words, you’re leasing them instead of buying them.

Here we will discuss what companies really mean when they offer solar panels for free. There are other ways to lower the upfront cost of a solar panel installation that yield greater savings in the long run. For example, you can apply for clean energy incentive programs or you can use a low-interest loan to finance your project.

IRS Form 5695. Solar Electric Tax Credits for Solar Panel Systems

If you’re interested in financing, you can click below to meet with a solar installer the Guides Home Team recommends.

- Why Are Companies Telling Me Solar Panels Are Free?

- Can You Get Free Solar Panels From the Government?

- How To Reduce Upfront Costs

- How To Choose a Reputable Solar Company

- The Bottom Line

- FAQ

Packages include 24/7 system monitoring 25-year warranty guarantees power production, product performance and workmanship Installation process is handled 100% in-house

Offers a range of financing options 24/7 customer service line Panel insurance protects against theft and damage

If ‘Free’ Solar Panels Aren’t Free, Why Are Companies Telling Me They Are?

If the offer doesn’t fit in any of the above categories, it may be a scam.

What Is a Solar Lease?

A solar lease is exactly what its name suggests. The provider installs solar panels at zero upfront cost, and you sign a contract wherein you agree to rent the system during a specified period (typically 10 to 15 years).

This agreement makes sense if the solar lease is priced lower than your monthly electric bills, but you can actually lose money if the lease is priced higher.

What Is a Power Purchase Agreement (PPA)?

You may be offered a solar power purchase agreement, or PPA. In this type of agreement, the solar panels are still installed on your roof at no cost to you. However, instead of paying a fixed monthly fee like in a lease, you are charged for the electricity generated by the solar panels during the billing period.

To make the deal attractive, solar PPA providers will charge a kilowatt-hour price slightly lower than local electric tariffs. Read the agreement carefully — some PPA contracts may try to charge you more.

What Are Government Solar Programs?

Government-subsidized solar programs do exist, but they are rare and only available for low-income households. These programs are normally managed by government agencies, regulated utilities or nonprofit organizations. Private companies may participate as approved installers, but they are subject to stringent guidelines.

To summarize, “free” solar panel offers are not always scams, but they are misleading. Many companies are more transparent in their sales pitch: They will clearly state that the upfront payment is zero, but you must sign a solar lease or PPA and make ongoing payments to the solar company.

Can You Get Free Solar Panels From the Government?

Generally speaking, you can’t get free solar panels from the government. Some government agencies have created programs that subsidize solar panels, but they are only available for low-income households that meet certain requirements.

The agency in charge of the program will filter applications by income level and hire qualified contractors to install solar energy systems. Other government programs may offer you a discount on your energy bills.

The Disadvantaged Communities Single-Family Solar Homes Program (DAC-SASH) in California is one example of a government program that offers an incentive of 3 per watt of solar capacity. According to the Center for Sustainable Energy. the average price of home solar installations in the U.S. is 3 to 5 per watt, which means this program could potentially cover 100% of system costs.

Share

From April, Greek households and farmers will be able to apply for public pandemic recovery funds to cover the purchase and installation of small PV arrays and energy storage systems, according to a recent statement by Greek Energy Minister Kostas Skrekas. Households will be able to obtain up to €16,000 each, while farmers can request up to €10,000 to cover such costs, said Skrekas, noting that the incentives will vary according to considerations such as capacity and the income levels of applicants.

Households and farming operations can install up to 10.8 kW of PV capacity and 10.8 kWh of battery storage. For residential users, battery installations will be considered mandatory, and must not have less capacity less than the photovoltaic arrays. However, farmers applying for subsidies will be free to decide on their own whether they wish to install batteries.

Rooftop and ground-mounted systems will be eligible for the subsidies. The program will also cover summer homes, but each applicant can claim funds for just one residential installation.

Greece’s new solar-plus-storage scheme has a €200 million budget, which stems from the country’s post-pandemic recovery plan. Of this, €35 million of funds are for vulnerable households facing energy poverty. About €85 million will be allocated to families with annual incomes up to €40,000 and single-person households with annual incomes up to €20,000. Families with annual incomes higher than €40,000, or individuals with incomes higher than €20,000 will claim funds from a €50 million subsidy pot. In addition, the government has established a separate €30 million subsidy pot for farmers.

The new scheme can cover between 20% to 65% of PV system costs, depending on the subsidy pot. For batteries, the first two subsidy pots will cover 100% of battery purchases and installation. The third and fourth subsidy pots will cover 90% of the battery costs. There is also a 10% subsidy bonus for disabled Greeks, single-parent families, and families with many children.

Popular content

The subsidy levels show that the government is very keen on battery installations. One of the main reasons for this is the grid’s struggle to accommodate new renewable power capacity.

Greece’s distribution grid operator, Hedno. has stopped accepting new requests to connect plants to its network since last year, and this is not set to change any time soon. The only exceptions to this are net-metering installations, for which Hedno has freed up about 2 GW of grid space. The 2 GW of grid space is available for small PV systems up to 10 kW in size, and will be offered on a first-come, first-served basis. About 40 of this will be offered to residential net-metering systems, while 30% of it will be given to small commercial PV systems. The remaining 30% will be allocated to agricultural PV projects.

pv magazine print edition

The April issue of pv magazine, due out in a week’s time, takes a look at how the long-established link between solar and cannabis cultivation can help improve margins as medicinal and recreational use of the drug comes out of the weeds. We take a trip Down Under to examine why communities are rebelling against planned renewable energy zones perceived as being railroaded through without sufficient local consultation, and we consider the “solar crime” wave sweeping the UK and Europe.

Another reason for the scheme’s lavish support for batteries is the government’s aim to maximize the self-consumption element of net-metered systems. Solar-plus-battery systems will only be able to inject power to the grid when both the site consumption and the charging of the battery are met. Similarly, the government says if a solar system does not generate enough power to cover a site’s needs, the user will only be able to buy power from the grid when the battery is empty. All solar-plus-storage systems supported by the new subsidy scheme will be obliged to operate under this business model for the first five years.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Share

Greek-born Ilias has written for pv magazine since 2012, reporting on renewable energy news, electricity market developments and energy policy. His geographic area of expertise includes Europe and the MENA region.

Subsidy Benefits

There are three parties involved in the process: 1. Customers, 2. Channel Partners, and 3. DISCOMS.

The subsidy is only available on Residential Homes (Individual Homes Big Apartments), not commercial and industrial sectors. A solar subsidy is only available on Grid Connected Solar System (Without Battery System). As installing a solar system is a huge investment, the financial assistance motivates people to invest and takes some burden off their shoulders.

Homeowners can only install a solar system and claim subsidy through the state DISCOM. They will share customer details and register the nearest channel partner. You can find a ll states DISCOMS from here.

If you install solar system though subsidy scheme, the solar installation company will provide 5 years of performance warranty, then after you are self responsible for your solar system.

This subsidy is not available for commercial and industrial customers because they can avail other benefits like accelerated depreciation, tax holidays, excise duty exemptions.

#2. Channel Partner Benefits

Channel Partners benefit from a larger customer base and more business. It is difficult for a common person to figure out the processes of getting the subsidy though he very much desires it. It is now that the channel partner comes into the picture. He tries to work with the customer and the government departments and expedite the process of getting a subsidy for the customer.

#3. DISCOMS Benefits

Power consumption demands reduce in residential sectors and they can give more in commercial area. We know that Commercial areas need more electricity than residential.

The customer is happy as he got his financial aid, the channel partner is happy as he got a new customer and the government is happy too as it is one step closer to its solar target installation.

Subsidy Demerits

Let’s see some demerits of subsidy scheme:

#1. Customer’s Demerits: I think, there are 2 major demerits, if we install solar system through government subsidy scheme.

- Less Warranty: If you install solar system through government solar subsidy scheme, then you will get full system warranty is 5 years. You will be change an inverter after 5 – 7 years.

- No Option for Top Brands – If you install solar system through this scheme, then you cannot force desired solar panel inverter brands, such as Loom Solar, Luminous, Microtek, Exide, Enphase, Solar Edge, etc.

#2. Channel Partner’s Demerits: As per discussion with industry experts, they face the following problems:

- Big Investment

- Not Assurity of Returning Subsidy Amount from DISCOMs after giving subsidy amount

- System Service Warranty for next 5 years

Solar Panel Subsidy Cost Estimation

Benchmark cost of grid connected solar system by MNRE, in 2022:

If you have planned to install solar system with latest technology product so average cost is Rs. 60,000 per kw across India but price differs little bit state to state also. This is average price without subsidy which includes product cost, installation cost, service cost for 5 years with net metering facility.

State Subsidy is Subject to UP Government.

Both central and state offer subsidy schemes to people for installing solar rooftop systems. The central government pays a 30% subsidy for these systems to states in general categories. For special states like states such as Uttarakhand, Sikkim, Himachal Pradesh, Jammu Kashmir and Lakshadweep, subsidy of up to 70% is given by the central government.

To avail subsidy, the average cost of installation of rooftop PV system without subsidy should be around Rs 60,000. 70,000. In order to avail generation-based incentive, the customer should generate 1100 kWh. 1500 kWh per year.

A person who is interested in getting a subsidy needs to follow some protocols. He will have to contact their electricity provider (or may even apply online with necessary documentation) who will visit the installation site for a review and give approval. Then the electricity provider visits for inspection. Customers can then avail the subsidy amount.

How to Verify Authorized Vendors/Channel Partners by DISCOMS?

I am sharing few guides to verify authorized vendors/channel partners that you can contact them. You have to visit on your DISCOM websites and search authorized channel partners list in your area and then contact them.

Government has revised solar system price every year. We are sharing with you for your reference. Most probably, you will get similar solar system price through solar subsidy.

Who’s proposing renewable energy projects?

We reviewed 191 wind and solar project applications filed in 2022. If built, these projects would almost double the number of renewable energy projects in Texas.

It is notoriously difficult to track the owners of renewable energy projects in the U.S., because most are structured as limited liability companies, or LLCs. However, the application for Texas incentives requires not only information on the owner, but also a signature of an individual representative of the owners. That provides a glimpse into the impact that subsidies can have and who benefits.

We found that just over a third – 69 out of 191 proposed projects – are owned by renewable energy companies, such as Danish company Ørsted and Recurrent Energy, owned by Canadian Solar.

Over half the proposals – 101 – were submitted by energy companies known more for oil and gas, or utilities with fossil fuel assets. This includes the renewable energy subsidiaries of oil supermajors such as Total and BP, and utility owners including EDF, AES and Engie, all of which are major global players.

Some project applications came from investment groups such as DeShaw Group, Cardinal Investment Group and Horus Capital. Apex Clean Energy, a renewable energy subsidiary of the major investment manager Ares Management, frequently showed up in applications.

New owners take over

The proposed projects provide a snapshot of the renewable energy projects’ developers – but what happens after these projects are built?

To figure that out, we also looked at all renewable energy projects completed in 2020 and 2021 that participated in the Chapter 313 incentive program.

To our surprise, almost half of the projects built in 2020 or 2021 had changed hands by 2022. Some were due to company acquisitions. Many other projects were sold.

This changed the composition of owners. While renewable energy companies owned roughly half the projects at the application stage, by 2022, two-thirds of the projects were owned by utilities and energy companies with fossil fuel assets.

The original developers may have benefited from the first year or so of the tax break, but the new owners are poised to reap the majority of the remaining years of the 10-year property tax incentive.

The most common pattern of sales was a renewable energy developer selling a project to an energy company or utility. For example, Duke Energy purchased a solar project originally owned by Recurrent Energy, and Alpin Sun sold a solar project to BP.

We found that ownership by self-described “venture capitalists” and other investors was rare before 2022. The lucrative and expiring incentive program likely led to a gold rush of applications, including by some companies with limited experience in renewable energy.

When renewable incentives become subsidies to fossil fuel companies

Many of the owners benefiting from these subsidies have parent companies with high carbon emissions and a history of fighting climate policies.

For example, the company with the most renewable energy projects subsidized under Chapter 313 from 2020 to 2022 is NextEra. NextEra is also the parent company of Florida Power and Light, a utility that has campaigned against rooftop solar in Florida and sued to block hydropower imports in Massachusetts. In Texas, however, NextEra lobbied for a continuation of Chapter 313 incentives.

Other major energy companies in the owner list include France’s Total Energy, BP, Duke Energy and Savion, which is owned by Shell.

The data suggests some possible tensions within green energy policy.

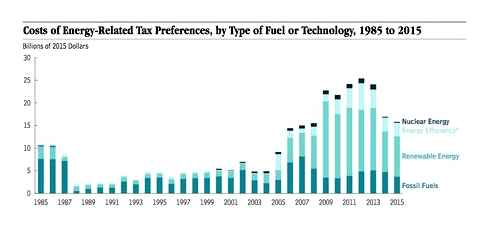

Environmentalists have long argued for federal and state subsidies for renewable energy as a means of combating climate change, including in the climate- and inflation-focused bill currently in Congress.

However, as our data analysis shows, the owners who benefit from renewable energy incentives can in some cases be the same fossil fuel companies that actively oppose a green energy transition. The results of a 2021 study, using data released by energy companies on earnings calls, also suggest that energy company investments in renewable energy projects are often simply diversification strategies – they aren’t replacing fossil fuels.

Our analysis is based on one program in Texas, but with the size of the Texas renewable energy sector, and the companies involved, it can offer insights for broader renewable energy policies.

Key to any subsidy program is clearly articulating the goals and tracking success in meeting them. If the goal is to reduce greenhouse as emissions, that means examining who is benefiting and determining if the subsidies are actually leading to a transition away from fossil fuels.

Our data begins to shine a light on the answer.

- Fossil fuels

- Renewable energy

- Solar power

- Wind power

- Subsidies

- Solar energy

- Wind energy

- Texas

- Fossil fuel industry

- Investors

- Fossil fuel subsidies

- Energy subsidies

- Audio narrated

- Inflation Reduction Act of 2022